Featured Products

Highly Recommended Products

New Products

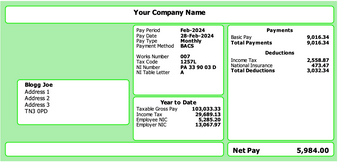

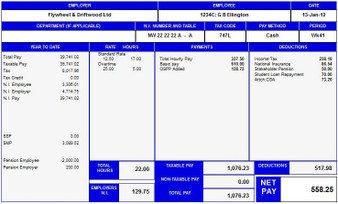

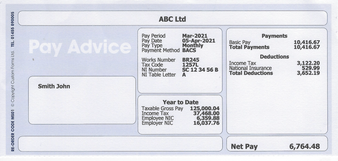

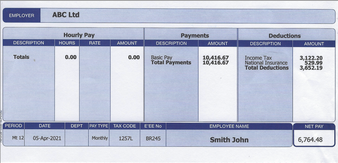

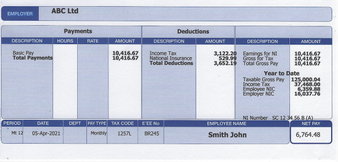

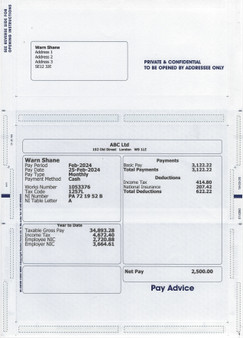

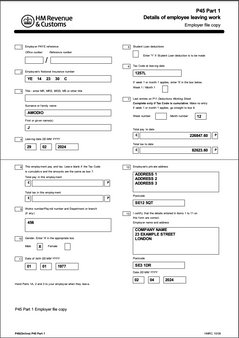

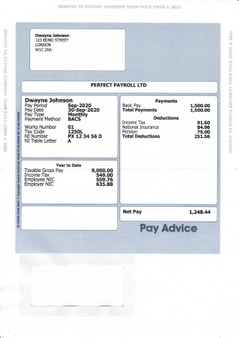

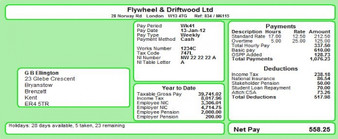

If you have lost a payslip and/or a p60, a replacement can be obtained. there is the best option when it comes to duplicates or replacement which is getting an online payslip and p60 online, Our payslip and p60 are the best as we guarantee it.

To generate your payslip or p60 online is very easy, just select the payslip type required follows after completing a short form provides you the information required in the document.

If it’s easier and possible – you can also get a duplicate or replacement payslips from your employer directly. You can call or email your employer and they will send you a paper version of your payslip as well that will include the same information as displayed on the online version. If you are having issues getting a replacement payslip, reach out to your HR department and they will help.

Maybe your employer is already using systems to provide online payslip. This is a rare option in the UK, but it is available. If you look at old payslips, you may realize that your employer doesn't like to provide company information on the payslip. Or, your employer may have closed and you can't get a duplicate or replacement of your employee p60. Fake payslip is a solution for those situations. Online fake payslips are prepared to look exactly like the original ones and provide the same data as original payslips.

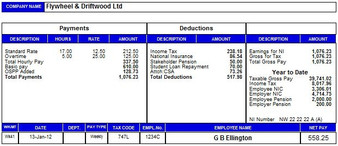

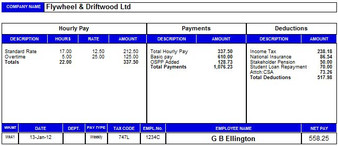

It is also very important to provide some information around fake payslips. If an employer fails to pay over the deducted taxes to HMRC: the question arises if the payslip is now illusory or illegitimate in some way? The answer is a complex one. The payslip, which records gross pay, net pay and all deductions, remains a valid record of the transaction that takes place: the employee provides the work, the employer pays for the work.

If the payslip records deductions ‘paid’ to HMRC but in reality they have not been paid over, then the process is compromised by the failure of the employer to fulfil its legal obligation by passing on the deducted sums to HMRC. But it would not be an example of the payslip proving ‘fake’ or ‘illusory’: the payslip records what timesheet information is communicated to the payroll software and how the payroll software operates the deductions and produces the payslip. The breakdown would be the result of the employer’s legal failure to pay over the deducted taxes to HMRC.

Notice that the description focuses on a lack of fulfilment of the employer’s legal obligations: the point is not, or should not be, whether HMRC actually receives the payment rather than it going to a fraudulent source. The point is simply whether these sums are paid over or not. If they are not, they are not taken out of the employee’s wages or salary – and this is the point on which the employee should focus.

An employee’s payslip is not illusory merely because of the fact that it records his or her net pay as a figure that is less than the gross pay. Nor is it illusory if the employer does not pay the tax over to HMRC: its illusory qualities, if any, lie in failing to deduct the tax in the first place. If an employer has fulfilled all its other legal duties to employees for the period in question, a misdescription of that process on a payslip would not invalidate the payslip itself.

The term ‘illusory’ is not a helpful descriptor. Any payslip other than one showing gross pay – the pay figure prior to tax, national insurance and other legal deductions being taken out – would be misleading. But there is nothing illusory about that. So, the point is whether the payslip is fake: is it a misrepresentation in any respect? Or whether it is illusory: does it mask the true nature of the relationship between the employee and his or her employer? These terms have connotations that may seem counterintuitive in this context.

Lifestyle Blog

Interesting Information About Payslips Online

Payslips a Legal requirement

Do you need to give your employees a payslip? This is a question that employers often ask, as th